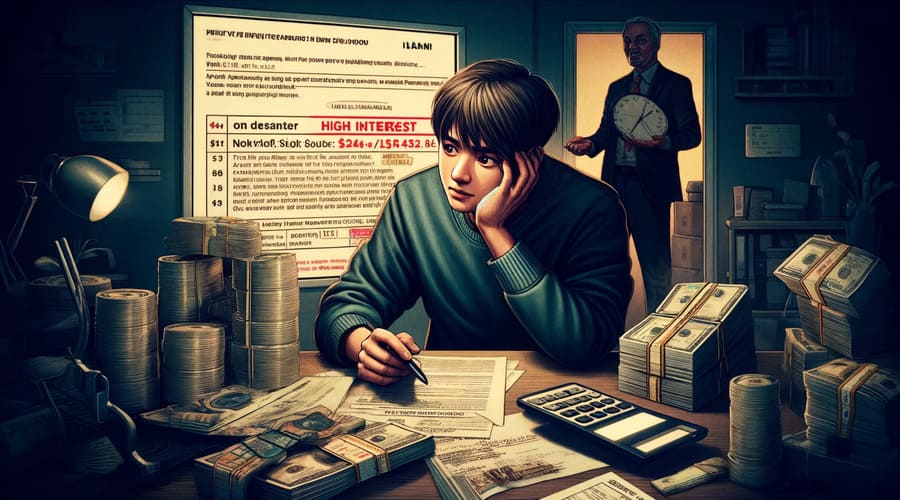

In today's fast-paced monetary landscape, many people and companies find themselves in want of quick funds to cover surprising expenses or to bridge short-term monetary gaps. This is where the concept of Small Amount Loans comes into play. These loans, often characterised by their comparatively low borrowing limit and fast approval process, have gotten increasingly in style among borrowers in search of quick entry to money without the lengthy utility procedures sometimes related to conventional financial institution loans. With the rise of digital banking, obtaining a Small Amount Loan has by no means been easier, but it is also essential for potential debtors to know the intricacies and implications of taking over such monetary obligations. What precisely are Small Amount Loans, and how can they serve your financial needs? In this text, we'll explore the details surrounding Small Amount Loans, their advantages, disadvantages, utility processes, and useful tips to ensure you make the most effective selections when contemplating this financial choice.